Senate Testimony Shows Rift Between Treasury and Fed: Live Updates

The chair of the Federal Reserve and the secretary of the Treasury painted starkly different visions of the challenges facing the United States economy in the months ahead on Tuesday, further exposing a rift that began to show last month.

While Jerome H. Powell, the Fed Chair, pointed to ongoing uncertainty over vaccine speed and distribution, the economic dangers of a surge in virus cases and the grim reality that many remain out of work while testifying before the Senate Banking Committee, Treasury Secretary Steven Mnuchin painted a sunnier image of the economic recovery, emphasizing state and local lockdowns as the main threat to growth.

The contrast underlines the divide between two economic policymakers who, earlier in the crisis, worked closely as partners to usher in a sweeping economic response.

That cooperation has cracked. Mr. Mnuchin announced in November that he would end several Fed emergency loan programs, which are meant to keep credit flowing to state and local governments and medium-sized businesses alike. Now, the pair are voicing starkly different economic diagnoses.

Mr. Mnuchin touted the strength of the economic recovery and blamed continuing economic shutdowns in some parts of the country for impairing progress, saying those are causing “great harm” to American businesses and workers.

The Treasury secretary pointed to fact that many jobs have come back and said the unemployment rate had dropped far faster than many had expected. While he agreed that some industries, like restaurants, need support, he reiterated that any additional fiscal spending should be “targeted.”

Mr. Powell warned that ”the outlook for the economy is extraordinarily uncertain” given the ongoing surge in virus cases. He said the winter could be a “tough few months” and small firms might go out of business, even though the economy might rebound strongly in the medium-term as a vaccine becomes available.

“We do have a long way to go,” Mr. Powell said, noting that 10 million people remain out of work and that it is possible to both acknowledge the progress and pay attention to the remaining gap. “We’ll use our tools until the danger is well and truly past, and it may require help from other parts of government as well, including Congress.”

The Fed Chair reiterated that positive clinical trial results for several vaccine candidates spell good news for the medium term, but warned that there are still big risks on the horizon, including related to the vaccine.

“For now, significant challenges and uncertainties remain, including timing, production and distribution, and efficacy across different groups,” Mr. Powell said.

Their testimony came as a bipartisan group of lawmakers unveiled a $900 billion rescue package that Senator Mark Warner, Democrat of Virginia, called the “best effort” to reach a framework that both Democrats and Republicans can agree upon.

Asked by Mr. Warner if they believed this type of package was needed, both Mr. Powell and Mr. Mnuchin agreed some form of additional support was needed.

“It sounds like you’re hitting a lot of the areas that could definitely benefit,” Mr. Powell said.

“We all believe that there should be targeted, fiscal response,” Mr. Mnuchin said, adding that he would be speaking to House Speaker Nancy Pelosi Tuesday afternoon.

Treasury Secretary Steven Mnuchin’s decision to end a series of Federal Reserve emergency lending programs at the end of the year prompted a heated back and forth during a Senate hearing on Tuesday, with Democrats blasting Mr. Mnuchin as trying to undercut the economic recovery and Republicans applauding it as a prudent decision.

Mr. Mnuchin announced in November that he would end Fed programs that have kept credit flowing to state and local governments and medium-sized businesses and asked the central bank to return more than $400 billion in unused funds that Congress appropriated earlier this year.

Mr. Mnuchin, appearing alongside Jerome H. Powell, the Fed chair, at Tuesday’s Senate Banking Committee hearing, argued that lawmakers had never expected the programs to continue “in perpetuity.”

He said that Congress should reallocate the funds if they wanted the money to continue supporting the economy.

Fed officials have made clear during speeches that policymakers at the central bank were disappointed with Mr. Mnuchin’s decision to end the programs. Mr. Powell signaled in his remarks that he thinks the emergency conditions that warrant such programs still prevail.

Mr. Powell said he has appreciated the relationship the Fed and Treasury have had, and that while the decision about the funding was “entirely” Mr. Mnuchin’s to make, the central bank would have left the facilities in place as backstops.

He noted that the Congress gave “sole authority over its funds” to the Treasury secretary and that the Fed will give the money back, as Mr. Mnuchin has asked. But he also said that the programs are “available only in very unusual circumstances, such as those we find ourselves in today,” showing that he does not believe conditions have returned to normal.

Senators broke along starkly partisan lines as they assessed Mr. Mnuchin’s decision — which was based on a reading of the law that the Treasury secretary only cited once it was clear that President Trump had lost the election.

Senator Sherrod Brown of Ohio, the top Democrat on the committee, assailed Mr. Mnuchin’s decision and accused him of “malpractice.”

“You appear to be trying to sabotage our economy on the way out the door,” he said.

Mr. Mnuchin defended his decision not to extend the programs, saying he negotiated the legislation that created them and insisting that Congress could not have intended for the facilities to be in place indefinitely.

“My decision not to extend these facilities was not an economic decision,” Mr. Mnuchin said.

He read directly from the legislation and argued that keeping the programs open would be forging a loophole in the law.

“I don’t believe that was the intent,” he said.

Republicans backed him up. Senator Patrick J. Toomey of Pennsylvania said that it is up to Congress, not the Fed, to figure out how to help “probably insolvent” companies and that the Fed’s emergency lending powers should not “morph” into something that serves as a supplement for fiscal policy — taxing and spending powers reserved for lawmakers.

Mr. Toomey said that markets are currently functioning smoothly, and while they could take a turn for the worse, that is always the case. Many critics of Mr. Mnuchin’s decisions have pointed out that risks are unusually elevated right now, as infections surge again and threaten the economy.

Two top Federal Reserve officials warned on Tuesday that the pandemic economic fallout could lead to greater inequality, and they urged greater government support to prevent divides from widening.

“There is a great risk of the pandemic making them worse,” Fed Chair Jerome H. Powell said, speaking before the Senate Banking Committee. He noted that women and minorities had been especially hurt by the crisis.

“There’s a real concern that if we don’t act as quickly as possible to support those people, get them back to work, get the economy up and running as much as possible, that we’ll leave behind a more unequal situation,” he said.

Mr. Powell’s colleague Lael Brainard, a member of the Federal Reserve Board of Governors, also voiced concern about the potential for an uneven recovery in a speech prepared for delivery to the Chicago Community Trust.

“While creating hardship for all, the pandemic has inflicted disproportionate economic pain on vulnerable businesses, sectors and demographic groups, which risks entrenching a K-shaped recovery that is weaker overall,” Ms. Brainard said. “Small businesses in consumer-facing sectors, along with many low-income workers, women workers and Black and Hispanic workers, are at a precarious stage of the pandemic.”

Mr. Powell suggested Tuesday that additional support could be needed from both the Fed and Congress to bridge the gap. He noted that the central bank intends to leave interest rates at rock bottom until the economy is healing, without working to pre-emptively choke off price gains — something that should pave the way for lower unemployment.

Ms. Brainard was even more blunt. “It is vitally important to provide a lifeline to hard-hit households and businesses facing the harsh reality of a resurgent Covid second wave as a bridge to the time an effective vaccine will be widely available,” she said in the prepared remarks.

President-elect Joseph R. Biden Jr. introduced key members of his economic team on Tuesday, as he prepares to assume the White House at a moment when the economic recovery from the coronavirus pandemic is slowing and millions remain out of work.

Mr. Biden, speaking at an event in Delaware, said he was building “a first-rate team that’s going to get us through this ongoing economic crisis.”

The president-elect called on Congress to pass a “robust” rescue package to help households, businesses and state and local governments, saying many communities are “teetering on the edge.”

Mr. Biden is poised to enter the White House at a time of national crisis amid the worsening virus outbreak. The Department of Labor and Department of Commerce have reported an increase in applications for state jobless benefits and a decrease in personal income. Coronavirus cases have soared in recent weeks, a development that Federal Reserve Chair Jerome H. Powell called “concerning” in testimony before lawmakers on Tuesday, saying it “could prove challenging in the next few months.”

In a sign of how critical a role economic policy will play in the Biden administration, the President-elect said he was returning the chair of the Council of Economic Advisers to a cabinet-level position. President Trump had demoted the C.E.A. chair during his administration.

Mr. Biden has chosen Cecilia Rouse to lead the Council of Economic Advisers; she would be the first Black woman in the role. Ms. Rouse is a Princeton economist who worked on the Council of Economic Advisers during part of the Obama era and on the White House’s National Economic Council during the Clinton administration.

Mr. Biden has warned of a “very dark winter” ahead and called on Congress to pass relief to help workers, businesses, and state and local governments. Mr. Biden’s advisers are preparing for what could be another economic downturn in early 2021. But another economic stimulus package has languished in Congress, where Democrats and Republicans have been unable to reach a deal, though leaders of both parties have called for compromise in recent days.

A bipartisan group of senators rolled out a potential compromise plan on Tuesday morning that appeared to fit the contours of what Mr. Biden, Speaker Nancy Pelosi of California and Senator Chuck Schumer of New York, the Democratic leader, have said must frame any stimulus deal in Washington. They include additional aid to the unemployed and small businesses, along with money to help state and local governments patch budget holes that have been ripped open during the pandemic.

Tuesday’s slate of nominees and appointees includes several women in top economic roles. The selections, markedly different from Mr. Trump’s cabinet, which has been overwhelmingly white and male, follow Mr. Biden’s campaign promise to build an administration that looks like America.

His pick for the Office of Management and Budget — Neera Tanden, the chief executive of the Center for American Progress — would be the first Indian-American to lead the office if confirmed. Mr. Biden also selected Janet L. Yellen, a former Federal Reserve chair, to be his Treasury Secretary. If confirmed, she would be the first woman to fill the position.

Ms. Tanden has met immediate resistance from Republican senators who have criticized her for attacking Republicans publicly, including on her Twitter feed. She previewed the group’s likely emphasis on personal stories in a Twitter post on Monday, after her nomination was announced: “After my parents were divorced when I was young, my mother relied on public food and housing programs to get by,” she wrote. “Now, I’m being nominated to help ensure those programs are secure, and ensure families like mine can live with dignity.”

Mr. Biden also announced his picks for deputy treasury secretary, Adewale Adeyemo, and members of the Council of Economic Advisers, Jared Bernstein and Heather Boushey.

Mr. Adeyemo served as a senior international economic adviser under former President Barack Obama, and Mr. Bernstein was Mr. Biden’s first chief economist when he was vice president. Ms. Boushey, a top policy adviser to Hillary Clinton in 2016, leads the Washington Center for Equitable Growth, a liberal think tank focused on inequality.

The introductions follow a similar event last week, when Mr. Biden publicly introduced members of his foreign policy and national security team.

Earlier this year, as the coronavirus pandemic forced cultural institutions to cancel events and performances, BookExpo, the largest publishing trade show in the United States, held out for longer than most. Initially scheduled for May at the Jacob K. Javits Convention Center in New York, it was postponed until July, then canceled and replaced with a virtual event.

Now, in a surprising shift, Reed Exhibitions announced that it has decided to cancel BookExpo for 2021, and to reinvent the trade show going forward.

In a statement on Tuesday, ReedPop, the pop culture event organizer within Reed Exhibitions, said that because of “continued uncertainty surrounding in-person events,” it is ending its current lineup and would solicit feedback from publishers, booksellers and other partners as it weighs how to structure the event in the future.

It’s unclear how big BookExpo and its related events will look in the future. Reed provided few specifics on Tuesday beyond saying that they would include “in-person and virtual offerings.”

The pandemic and shutdown have been devastating to the events industry. Reed Exhibitions has undertaken cost-cutting measures, including layoffs, but many of its planned conventions for 2021, including comic conventions in Chicago and Seattle, are still going forward.

BookExpo has been a central event for the publishing industry for decades, dating back to when the American Booksellers Association Convention was founded in 1947. Reed, which puts on about 500 events in dozens of countries each year, has run the event since 1994.

In previous years, BookExpo has drawn several thousand publishing professionals, booksellers, librarians, agents and authors. It has been a crucial way for publishers to promote their upcoming books. Since 2014, the event has been open to the public as well as industry professionals, with a spinoff called BookCon.

The events have featured appearances by best-selling authors like Dan Brown, Margaret Atwood and John Grisham, and celebrities like Tina Fey, Amy Poehler and Martin Short.

In 2019, more than 8,000 people attended the industry side of the expo, and roughly 20,000 people attended the BookCon author events that were open to the public. Some 500 companies exhibited on the event floor at the Javits Center.

The live events, where editors, agents and authors and booksellers mingle and network, were impossible to replicate online. Still, this year’s virtual convention drew a large audience, with some 400,000 viewers joining online events for BookCon.

Kohl’s, the affordable apparel chain, will install Sephora cosmetics shops in its stores beginning in the fall of 2021, the companies said on Tuesday, the latest sign of retail power shifting away from malls and department stores.

The announcement came after Target said it would host Ulta shops, which sell beauty products, within its stores next year. And it followed the bankruptcy this year of J.C. Penney, which has hosted hundreds of Sephora shops inside its department stores for more than a decade. Sephora, which reached a settlement with J.C. Penney over the shops earlier this year, said that partnership was scheduled to wind down in early 2023.

Kohl’s, which has 1,100 stores that are often located in strip malls, plans to open 200 “Sephora at Kohl’s” locations next fall and operate more than 850 of the shops by 2023. The Sephora shops are designed to be 2,500-square-foot spaces located at the front of Kohl’s stores, and the brand’s products, which include makeup, fragrance and skin care items, will also be available on the Kohl’s website.

Kohl’s has also given up space in its stores to Amazon in recent years, accepting and processing returns on behalf of the e-commerce giant, in an effort to attract new and younger customers into its physical locations. Sephora is owned by LVMH Moët Hennessy Louis Vuitton.

A bipartisan group of senators on Tuesday unveiled a $900 billion compromise stimulus proposal meant to break the stalemate in Congress over delivering additional economic relief to Americans suffering from the impact of the coronavirus pandemic.

The proposal, spearheaded by centrist Senators Joe Manchin, Democrat of West Virginia, and Susan Collins, Republican of Maine, has not been endorsed by either Speaker Nancy Pelosi of California, or Senator Mitch McConnell, Republican of Kentucky and the majority leader.

Designed as a stopgap measure to last until March, it would restore federal unemployment benefits that lapsed over the summer, but at half the rate, providing $300 a week for 18 weeks, and does not include another round of checks for every American. The measure would provide $160 billion to help state, local and tribal governments facing fiscal ruin — a fraction of what Democrats had sought. Also included was $288 billion to help small businesses and a short-term federal liability shield from coronavirus-related lawsuits.

The bill is an attempt to find a middle ground between the dueling stimulus proposals that Democrats and Republicans have haggled over for months. Its cost is less than half of what Democratic leaders had pushed for in the weeks leading up to the election, but nearly double the latest proposal from Republican leaders.

“It’s inexcusable for us to leave town and not have an agreement,” Mr. Manchin said at a news conference on Capitol Hill to present the plan, which was developed with Democratic Senators Mark Warner of Virginia, and Jeanne Shaheen and Maggie Hassan, both of New Hampshire; independent Senator Angus King of Maine; and Republican Senators Bill Cassidy of Louisiana, Lisa Murkowski of Alaska and Mitt Romney of Utah.

Joining them to announce the outline were leaders of the House Problem Solvers Caucus, a bipartisan group that announced a similar compromise proposal earlier this year that House leaders quickly dismissed.

The fresh attempt at a bipartisan compromise came as Ms. Pelosi and Steven Mnuchin, the Treasury secretary, were set to discuss government funding legislation, a conversation that Mr. Mnuchin told reporters he also expected would touch on coronavirus relief. It marks the pair’s first discussion on a bill since late October, when they had a flurry of pre-election conversations about coronavirus relief.

Though the framework unveiled on Tuesday was endorsed by moderate members of both parties, any deal would need support from leaders in both chambers to become law, and aides and senators conceded that the first step toward a final deal would require that endorsement.

But in an effort to pressure their leaders, more rank and file lawmakers have begun to call for a smaller, compromise package that could avert the impending lapse at the end of the year of a series of relief programs established in the $2.2 trillion stimulus law enacted in March.

Lawmakers are facing a tight time frame: Government funding is set to lapse on Dec. 11, and with coronavirus cases spiking across the country, they are rushing to approve a must-pass spending bill to avert a shutdown and leave Washington for the remainder of the year.

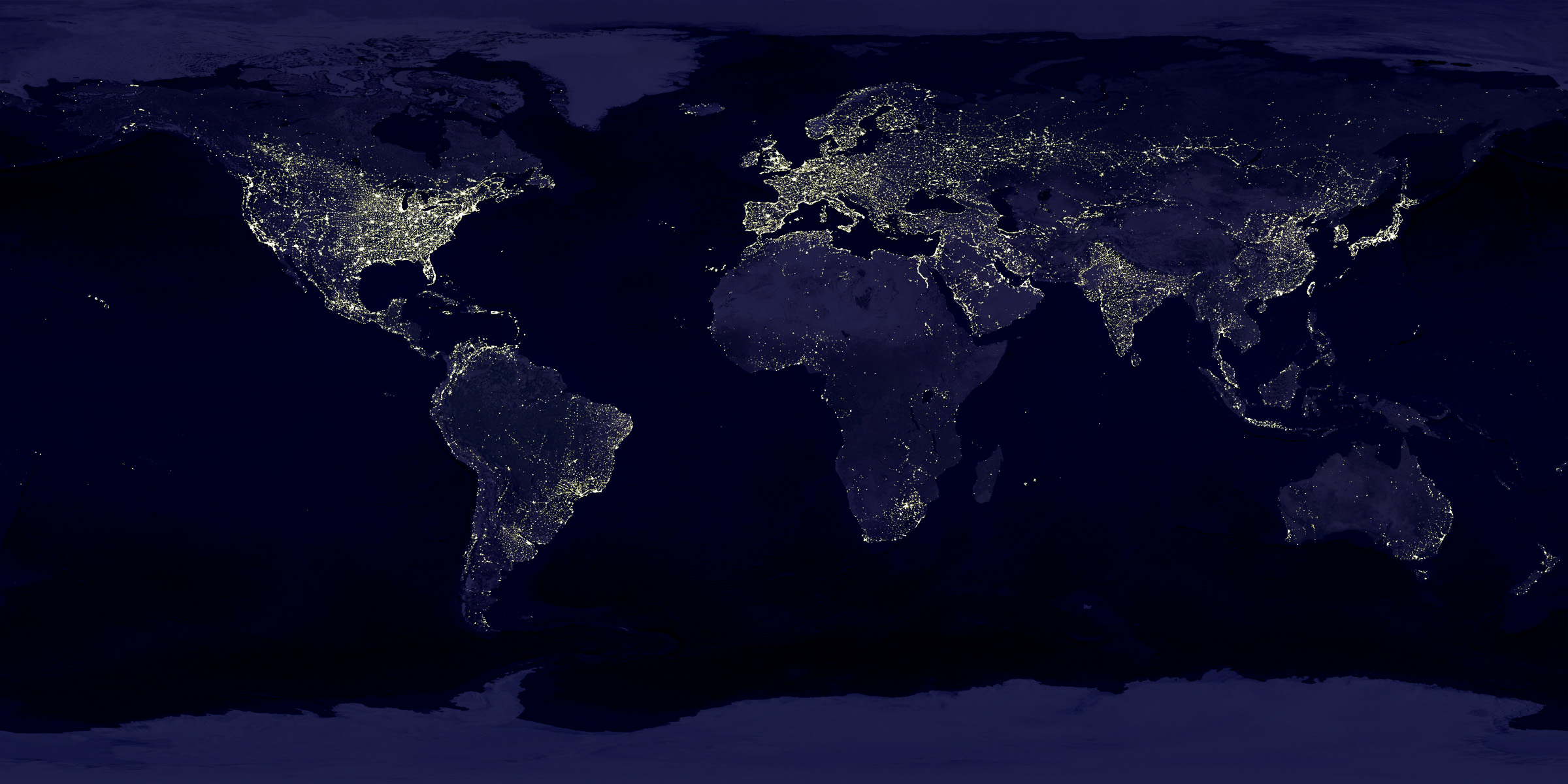

By: Ella Koeze·Source: Refinitiv

Stocks were on track to reach new highs on Tuesday, extending last month’s rally. Investors appeared to be looking beyond what is likely to be a bleak winter — with rising virus cases and businesses trying to survive lockdowns — and focusing instead on the prospect of the potential rollout of vaccines next year and renewed optimism around stimulus in the United States. European and Asian stocks were also higher.

The S&P 500 index rose about 1.4 percent in early trading, a gain that would put it back in record territory. November was the strongest month since April for the S&P 500 and the second strongest month since 2011, as stocks were propelled higher by relief over vaccine development and the conclusion of a turbulent U.S. presidential election.

Investors’ spirits were lifted by the introduction on Tuesday of a $908 billion stimulus proposal by a bipartisan group of senators that was aimed at restarting aid negotiations.

Stocks tied to expectations for more stimulus fared well. The solar energy stocks NextEra Energy and Sunrun — well positioned for a climate-related infrastructure stimulus push — both rose. The machinery rental company United Rentals and asphalt makers Martin Marietta Materials and Vulcan Materials also jumped on hopes for a new road building program.

Asian markets rose on Tuesday after data showed Chinese manufacturing activity expanded at its fastest pace in a decade, and exceeded analysts’ expectations, according to the latest report from Caixin and IHS Markit. The Shanghai composite index rose 1.8 percent, the Hang Seng Index in Hong Kong was 0.9 percent higher and the Nikkei 225 in Japan gained 1.3 percent.

In Europe, Britain’s FTSE 100 climbed nearly 2 percent, while benchmarks in Germany and France were about 1 percent higher.

The Organization for Economic Co-operation and Development presented a counterargument to the optimism in financial markets on Tuesday. It lowered its forecast for global growth next year to 4.2 percent, saying the economy will “gain momentum only gradually” and China will account for more than a third of the growth.

Tesla rose about 4 percent in early trading, after S&P Dow Jones Indices said it would add the stock to the S&P 500 in a single step later in the month. S&P Dow Jones had been weighing adding Tesla to the index in a two-step process because of the company’s large market capitalization.

Arcadia Group, the British retail company owned by Philip Green that includes the Topshop clothing chain, has gone into administration, a form of bankruptcy, the company said Monday. It is one of the biggest retail collapses in Britain since the start of the pandemic. Deloitte has been appointed as the administrator. Arcadia, which has 444 stores in Britain, 22 overseas and about 13,000 employees, said it would keep operating during administration.

Meredith Corporation has parted ways with J.D. Heyman, the editor in chief of Entertainment Weekly magazine, the company confirmed on Monday. A Meredith spokeswoman said that the end of the editor’s tenure at the publication would go into effect “immediately.” The reason was not disclosed.

DoorDash said on Monday that it hopes to raise up to $2.8 billion from its initial public offering, in a sale that could value the company at as much as $31.6 billion, including all shares and options. It has set a price range of $75 to $85 a share for the I.P.O. The fund-raising goal, disclosed in the food-delivery company’s latest I.P.O. prospectus, signals the company’s ambitions as it begins pitching prospective investors. It was valued at $16 billion in a private fund-raising round in June.