Supply chains for different industries are fragmenting in different ways

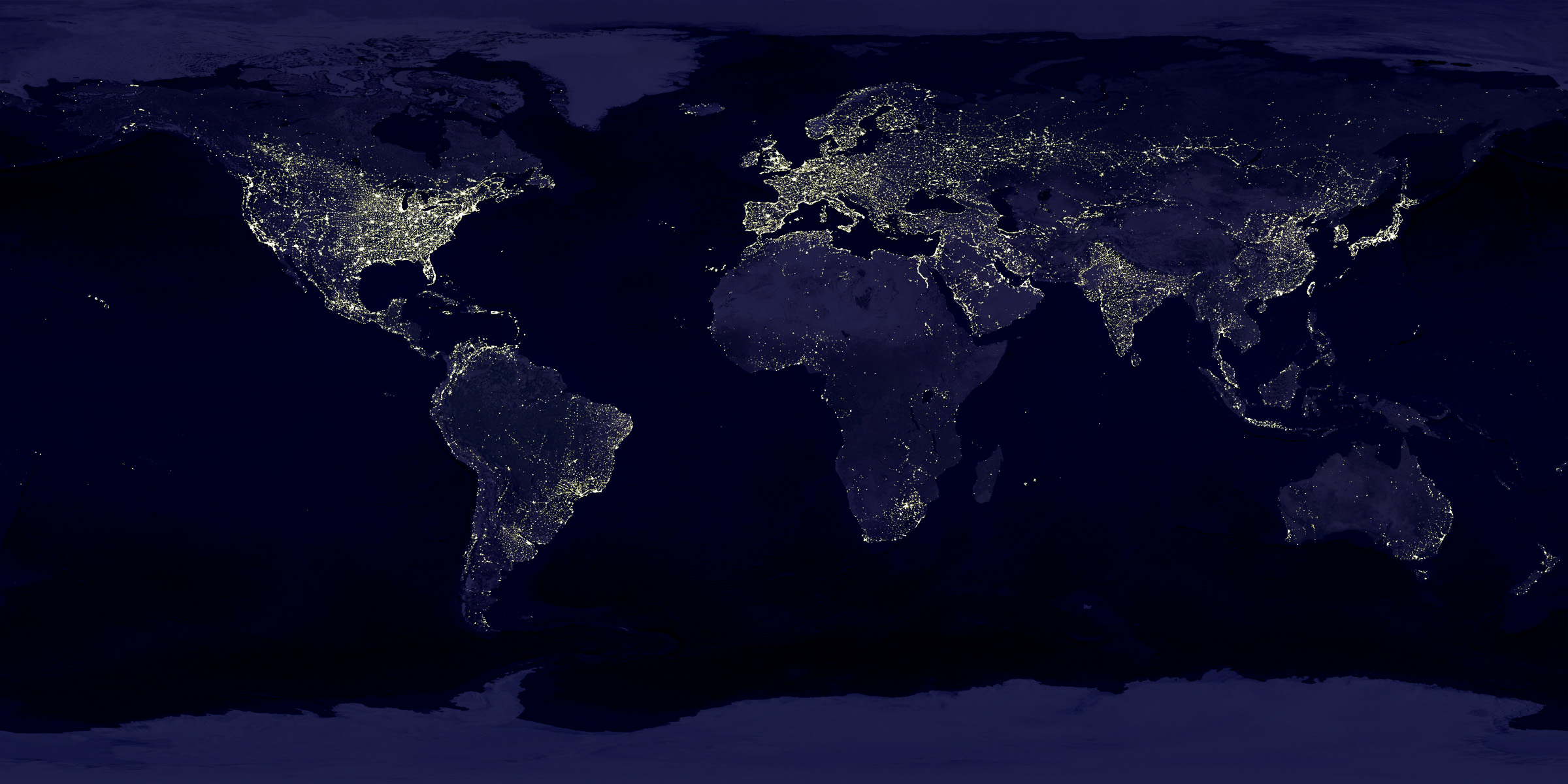

GLOBALISATION IS BECOMING regionalisation. Analysis by MGI finds that the global value chains (GVCs) in 16 of 17 big industries it studied have been contracting since the global financial crisis. Trade continued to grow in absolute terms from 2007 to 2017, but during that period exports in those same value chains declined from 28.1% to 22.5% of gross output. The biggest declines in trade intensity were observed in the most heavily traded and complex GVCs, such as those in clothing, cars and electronics. As MGI’s Susan Lund explains, “more production is happening in proximity to major consumer markets”.

China’s role as the world’s workshop is starting to fade, but surprisingly this may not sound the death knell for mainland manufacturing. Thanks to its skilled labour force and excellent infrastructure, China remains an outstanding place to make things, hence its continued strength in numerous sectors (see chart). Also, the rise of the Chinese middle class has led many firms to redirect production to serve the local market. So MNCs are clearly rethinking the old linear sourcing model for Western markets, but the path forward is unclear. Different industries will make different choices.

Corporate supply-chain data are often opaque and official trade statistics typically lag by years. Yet talking to many firms in three...